What are Card-Linked Offers?

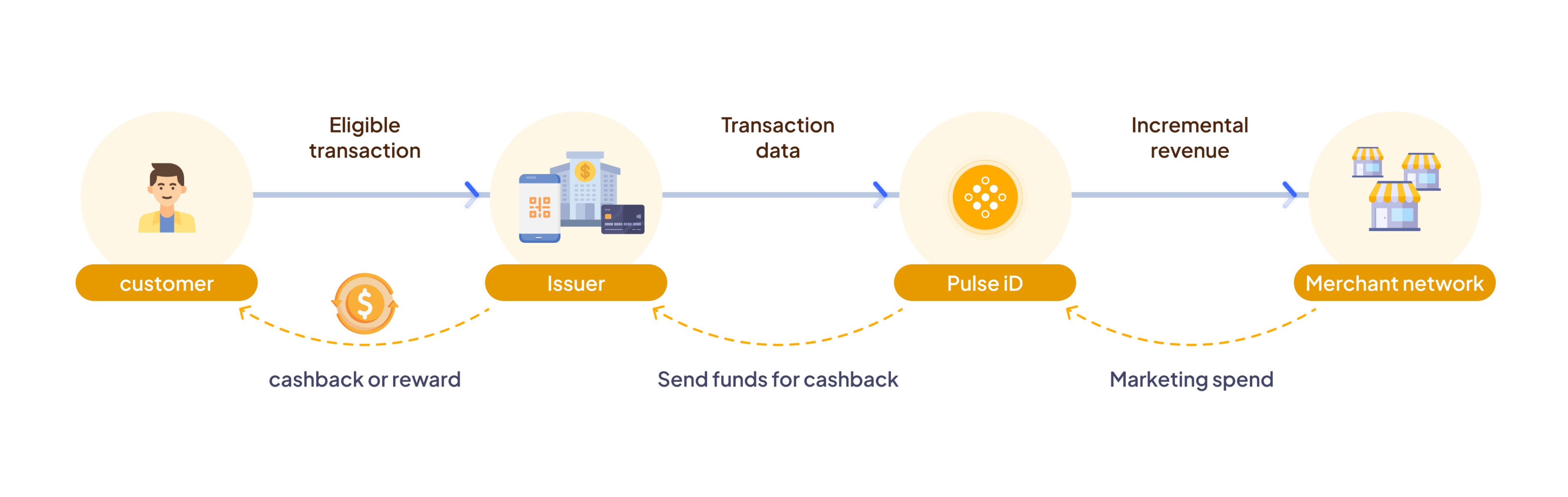

CLOs represent a synergistic blend of marketing and loyalty strategies, ingeniously connecting promotional offers directly to a consumer’s debit or credit card. This innovative approach eliminates the need for physical coupons, significantly streamlining the redemption process. When cardholders make purchases at participating retailers, these offers are automatically applied, leading to direct savings or the accrual of rewards.

The Growing Significance of CLOs

A major shift in customer engagement is signified by the rise of CLOs. In 2022, an impressive 45% of survey respondents reported using Card-Linked Loyalty programs, up from 34% in 2020. This surge indicates a mainstream embrace of this technology.

CLOs offer:

-

- Personalized Engagement: Customizing offers based on individual spending patterns through AI and data analytics.

- Seamless Experience: Customers enjoy direct rewards through card transactions, devoid of any additional steps.

- Personalized Engagement: Customizing offers based on individual spending patterns through AI and data analytics.

Key Trends in CLOs to Watch

- Mainstream Adoption: The Digital Commerce Annual Study revealed a notable increase in CLO usage, with 45% of respondents in 2022 engaged in Card-Linked Loyalty programs, compared to 34% in 2020.

- Consumer Price Sensitivity: A significant 84% of consumers showcased a preference for cash-back discounts over other forms of rewards, highlighting a trend towards price-sensitive purchasing decisions.

- Rising Marketing Channel: Markedly, CLOs have become a major marketing tool, commanding an increasing share of advertising budgets. In 2022, over 15% of marketers allocated between 30-50% of their budget to CLO programs, marking its growing significance.

"52% of respondents in 2022 used card-linked offers as a potent marketing tool, trailing just behind social media and SEO marketing."

Impact on Banks and Retailers

CLOs present unique advantages for both financial institutions and retailers:

-

- For Banks: CLOs are a tool to enhance customer relationships, boosting card usage and engagement, thereby driving transaction volumes and fostering customer loyalty.

- For Retailers: These offers provide a platform for hyper-targeted marketing, increasing sales and customer acquisition. Retailers also gain invaluable insights into consumer behavior, aiding in the development of future marketing strategies.

As we navigate through an era of digital transformation, CLOs stand as a beacon of innovation. They drive personalized customer experiences and forge meaningful connections between brands and their customers. Far from being just an option, CLOs have become a necessity for businesses aspiring to thrive in a competitive landscape. CLOs also make it easy to track accounting and bookkeeping. There are government grants like the accounting system grant so CLOs can be a great integration if you’re already with an accounting system.

"More than a third of marketing budgets are now being devoted to card-linking, up from 30.9% the previous year."

Embracing the Future with Pulse iD

Are you prepared to leverage the transformative power of card-linking technology in your loyalty program?

Partner with Pulse iD and embark on a journey to unlock groundbreaking opportunities in customer engagement and loyalty.

Pulse iD stands at the forefront, offering innovative solutions that harness the power of card-linked technology, ensuring your business stays ahead in the game of customer engagement and loyalty.